Getting Help With Your Filing Your Income Tax Returns

Though it is still early in the year, it is never too early to get organized with your finances and get ready to file your taxes. For many people this can seem to be a complicated, confusing, and daunting topic. Fortunately there are several services available for you to help you get through the maze.

In Broward County there is a program, formerly known as Volunteer Income Tax Assistance (VITA), that is now called Broward Tax Pro. This free service is provided at no cost to caregivers whose annual household income is less than $66,000. According to the program’s website, the service is provided by “trained, qualified, tax professionals who will prepare taxes at no cost, and determine an individual’s eligibility for special tax credits such as Earned Income Tax Credit (EITC), Child Tax Credit, and Credit for the Elderly and education credits to assist taxpayers in maximizing their returns refunds.” They also have a free hotline to help assist you with any general tax questions.

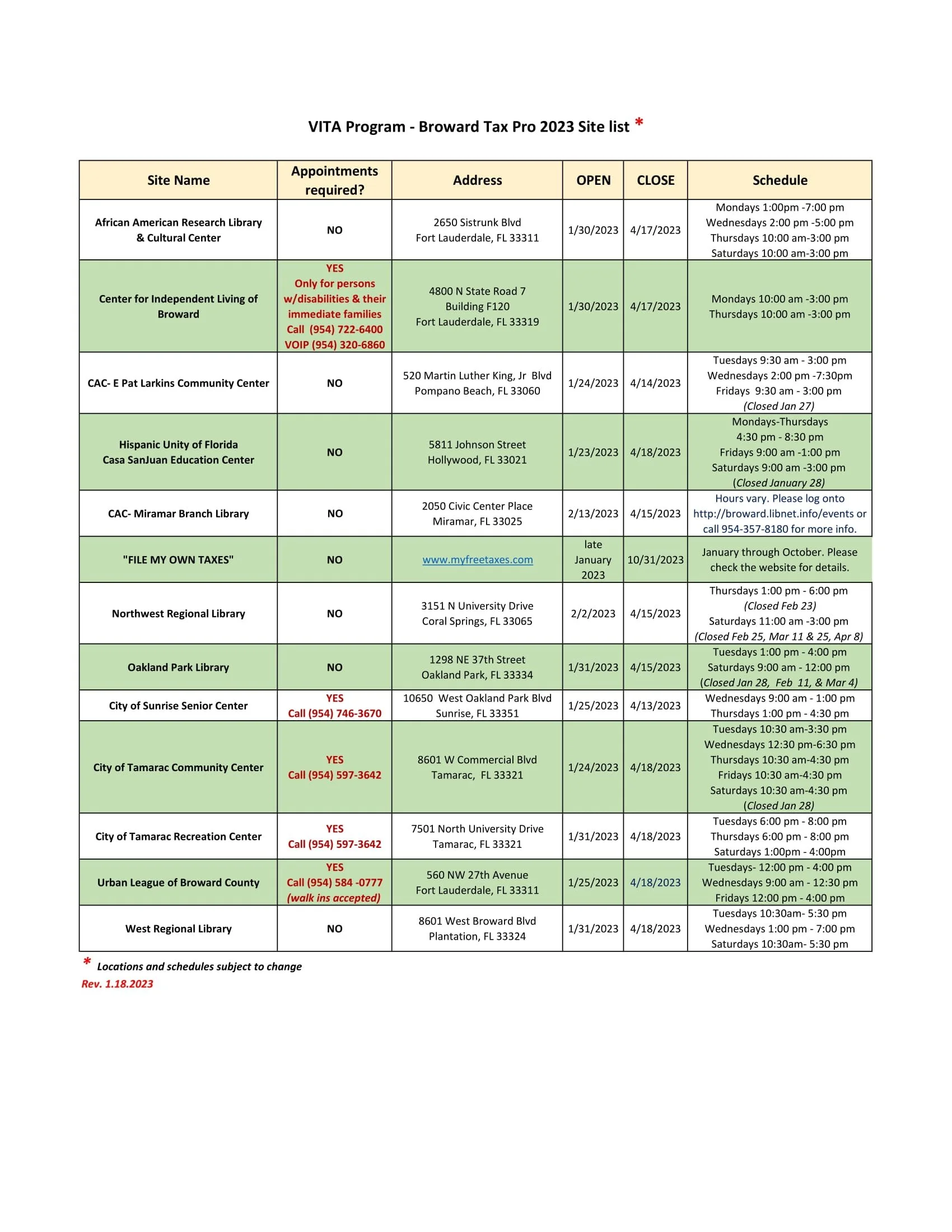

Though the program’s name has changed to Broward Tax Pro, the website can still be found at this internet location: VITA Taxes Free. The site is available in English, Spanish, and Creole. If you would like to visit the service in Broward County in person, below is a list of local offices.

If you instead are interested in filing your taxes virtually by yourself, MyFreeTaxes by United Way | MyFreeTaxes is a service sponsored by the United Way, and has no annual income or age limitations. In a recent article, the New York Time’s Wirecutter section recommended the free edition of the online program TurboTax, which available for people who have “simple” tax returns. You can check on the website to see if you qualify.

Last but not least, AARP Foundation Tax-Aide Service provides in-person and virtual tax assistance to anyone, free of charge, with a special focus on taxpayers who are over 50 or have low to moderate income. Tax-Aide volunteers are located nationwide, and are trained and IRS-certified every year to make sure they know about and understand the latest changes and additions to the tax code. Their website has a locator feature that you can use to help find the closest location. You can see their “Frequently Asked Questions,” and call them at 888-687-2277, toll-free.

Below is a list of local sites that you can visit in-person: